utility for service tax return

Download XML Schema for ST3 Return V16. According to Oracle NetSuite Internet expenses are often classified as utilities.

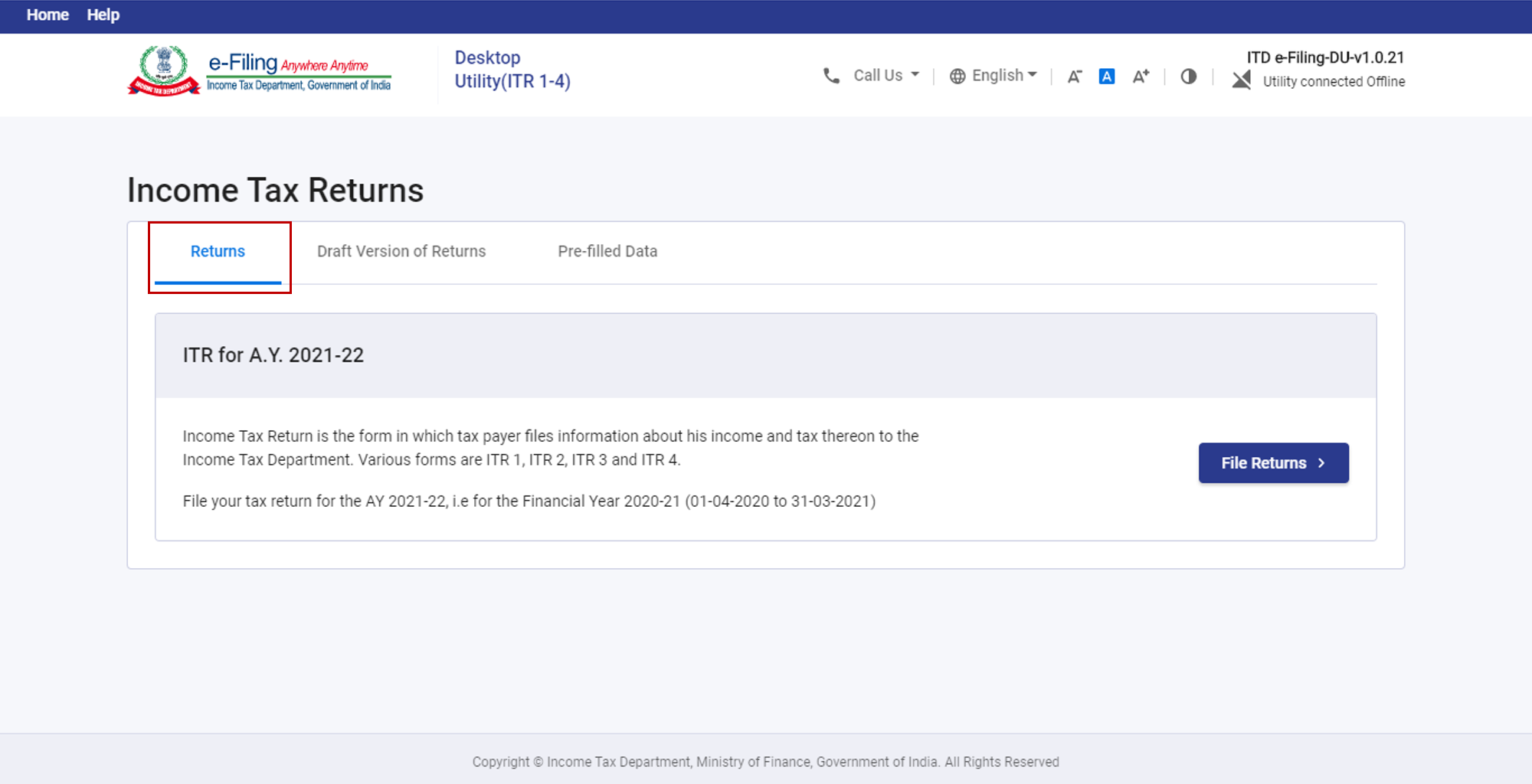

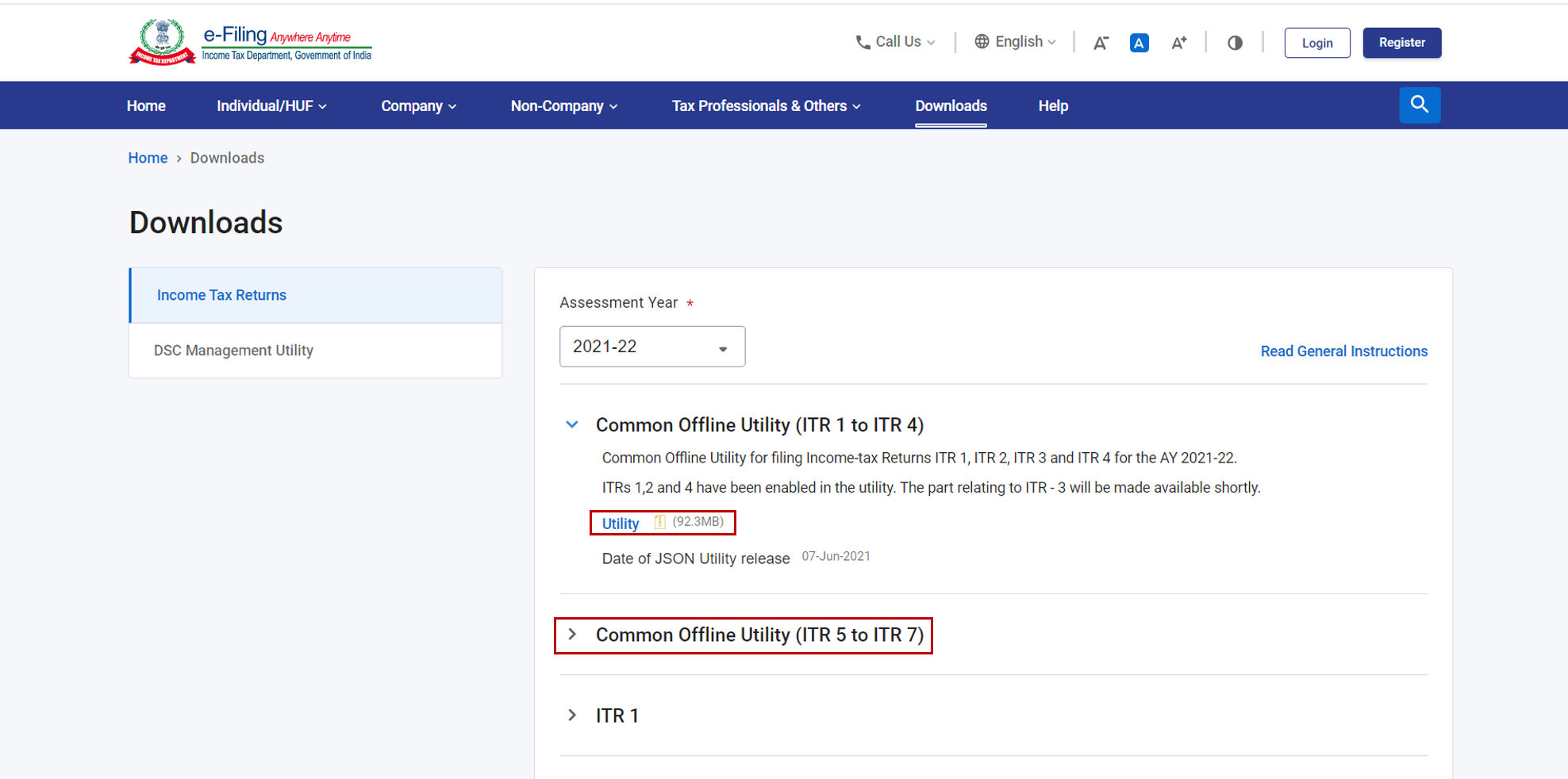

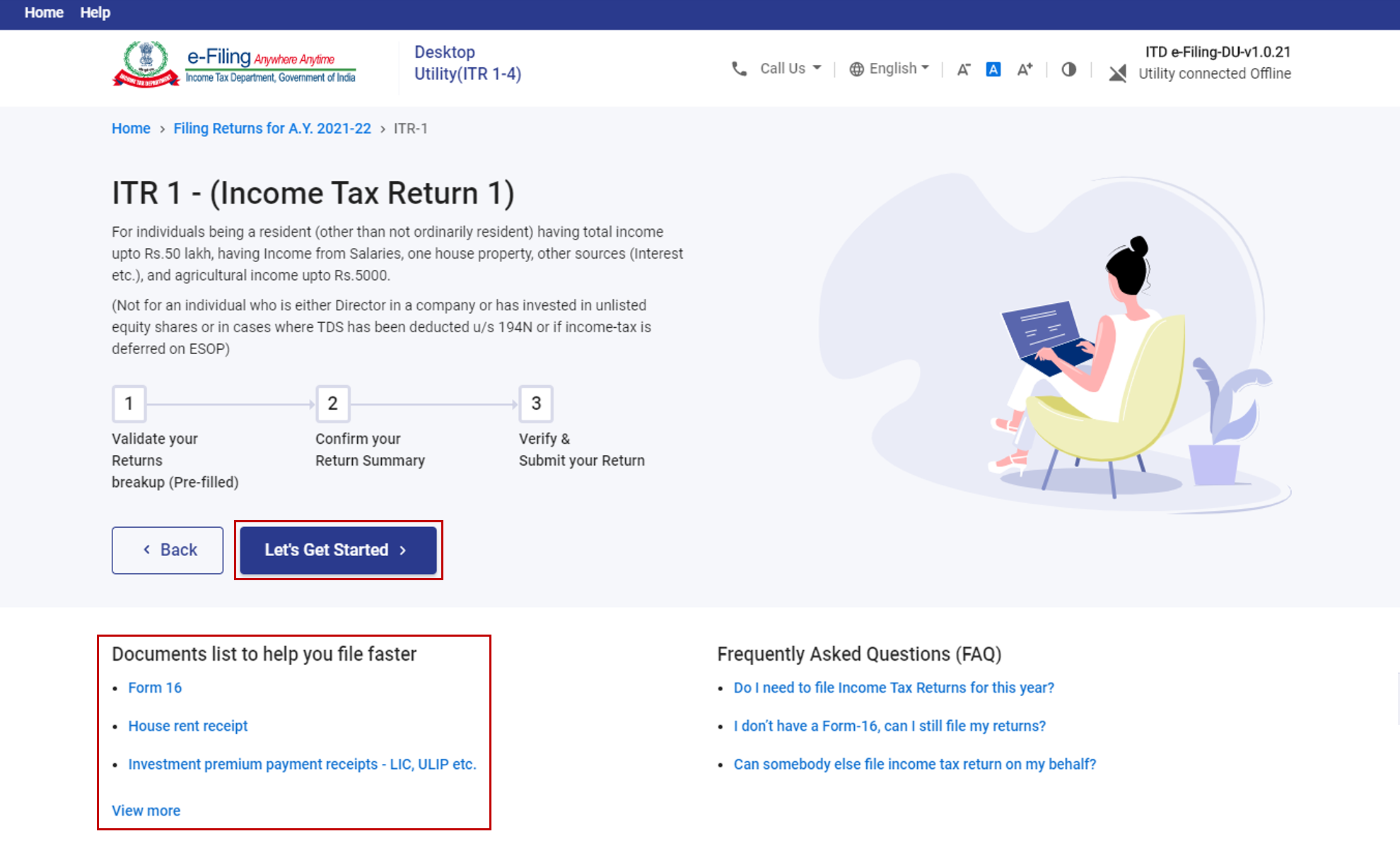

Offline Utility For Itrs User Manual Income Tax Department

Utility Expense Business Deduction.

. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. For Memorandum of Cross-Objections to the Appellate Tribunal. Documents on this page are provided in pdf format.

Return of Service Tax Excel Utility Form ST-3. The service provider collects the tax based on the rate established by the local authority. Prior to February 2019 these customers seeking a utility sales tax exemption were required to complete Form ST-200 to receive an ST-109.

Now click on Validate this sheet option in order to make sure that the sheet has been properly. Service Tax Appeal before Appellate Tribunal us 862 or us 862A Form ST-7. The person liable to pay Service Tax should himself assess the Tax due on the Services provided by him and shall furnish to the Superintendent of Central Excise on a half yearly basis in Form ST-3.

NYC-98UTX - Claim for Lower Manhattan Relocation Employment Assistance Program LMREAP Credit Applied to the Utility Tax. NYC-UXP - Return of Excise Tax by Utilities for use by utilities other than railroads. Please include your business name customer number or City account number type of utility you provide eg electric telephone and the desired reporting frequency annual quarterly or monthly.

For the entire year if you had the home business for the entire year. 117 of gross income. In order to fill your service tax return through offline utility you will have to first file return through offline utility and then it will be uploaded to ACES application.

2007-2021 Utility Tax Service LLC. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Omnibus operators subject to NYS Department of Public Service supervision.

You pay 153 for 2017 SE tax on 9235 of your Net Profit greater than 400. If the business utilizes the Internet regularly to service its customers and is unable to complete the servicing. To register for Seattle utility taxes email taxseattlegov.

Currently we represent over 100 Special Districts in Aransas Brazoria Cameron Chambers Collin Denton Fort Bend Galveston Guadalupe Harris Kaufman Kendall Liberty. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Returns are due on the 20th of the following month.

Download ST3 Return Excel Utility V16 For filing ST-3 Returns for Half Year Apr-Sept 2016-2017 onwards 01-10-2016. Ad IRS-Approved E-File Provider. 235 of gross income.

An online filing system is available for the Utility Gross Receipts License Tax Return which will allow for the timely filing and subsequent allocation of tax payments to the school districts. Energy Assistance Charges Renewable Energy Charges. Tax Deductor Collector.

From Simple to Advanced Income Taxes. The utilities and utility vendors that have to pay this tax include. You must file a monthly return even if no tax is owed.

First download the excel utility and fill up the return data using it. Memorandum for Provisional Deposit of Service Tax. NYC-95UTX - Claim for REAP Credit Applied to the Utility Tax.

Section 70 1 Finance Act 1994. Business tax returns go under the other deductions line item on the face of the tax return. The Service Tax return is required to be filed by any person liable to pay the Service Tax.

Companies that derive 80 percent or more of gross receipts from mobile. Total gross sales to Indiana consumers by utility service providers collecting USUT Enter the amount of gross receipts received for furnishing utility services on. If you own a business the utility taxes you pay on its behalf are usually deductible.

Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility sales tax. Companies that are subject to the supervision of the New York State Department of Public Service such as gas and electric companies telephone companies and certain transportation companies. The last date of filing the ST3 Return for the said period is 25th October2016.

Make sure all preprinted information is correct for the tax period you are filing. If your electric bill was 100 each month that would be 1200 for the year. Effective July 1 2021 changes in billing frequency take effect.

The tax is imposed on persons distributing supplying furnishing or selling electricity in Illinois for use and consumption not for resale. Each public utility must collect an Energy Assistance Charge and Renewable Energy Charge monthly from each of its customers. Unlike office expenses office utilities are required for the business operations and include items such as electric gas and telephone services.

Current Utility Tax Forms 2021 Utility Tax Forms. Utility 1036 MB Date of Utility release 02-Jun-2022. Only utility expenses you incur for your business offices and buildings are deductible.

Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23. The basic utility tax rate is 235 of gross income or gross operating income. If youre a sole proprietor and you work.

To avoid congestion and inconvenience in the last minute all assessees are requested to file their ST3 Return for. Goods and Services Tax. Utility for e filing Service Tax Return ST3 for the period April2016-September2016 is available from 1102016 in both Online and Offline modes.

Utility Tax Service LLC was established in October 2004 and we are committed to providing our clients with the highest quality service in the property tax industry. However different rates apply to bus companies and railroads as shown below. If your office uses 15 office square footage is 150 and your home total square footage is 1000 then 1501000 015 X 100 15 of your home then you will deduct 15 of 1200 and you.

Please note that a separate return must be filed for each utility service. Please sign and date each return. Click here to read the notice regarding billing.

Service Tax Appeal before Commissioner Appeals. Information contained in this website is subject to change without notice. Quickly Prepare and E-File Your 2021 Tax Return.

Please contact the tax office if you have any questions. Weve Filed Over 50 Milllion Tax Returns With The IRS.

Revised Due Dates Itr Audit Gst Income Tax Return Due Date Audit

Streamline And Automate Your Work According To Your Need The Only Solution You Need To Manage All Your Tax Compliance Needs Sp Tax Software Solutions Income

Usa Texas City Of Laredo Utilities Department Water Utility Bill Template In Word And Pdf Format Gotempl Templates With Design Service In 2022 Bill Template Water Utilities Laredo

Indian Income Tax Taxpayer Services Identified For E Delivery Accounting Taxation Income Tax Business Tax Income

Laos Indochina Bank Statement Easy To Fill Template In Excel Format Statement Template Bank Statement Templates

Offline Utility For Itrs User Manual Income Tax Department

Pin By Ca Devesh On Goods Service Tax Gst In 2021 Generation Informative Goods And Service Tax

Offline Utility For Itrs User Manual Income Tax Department

Free Pan Allotment In 10 Minutes Income Tax Department Launches New Utility Free Pans Income 10 Things

Australia Macquire Bank Statement Easy To Fill Template In Excel Format Statement Template Bank Statement Templates

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates

Read Income Tax Return Filing Guidelines For Nri If You Are An Nri Who Lost Connection With Your Motherland But Not The Income Tax Income Tax Return Tax Guide

Download Gstr 4 Form Offline Utility V3 3 In Excel Format Sag Infotech Business Software Excel Offline

Scanned Document Editing Service Tax Deductions Deduction Bank Statement

Income Tax Return 2019 Last Date Tax Return Income Tax Return Income Tax

Pin By The Taxtalk On Income Tax In 2021 Tax Refund Income Tax Chartered Accountant

Send Itr V In Tax Department Income Tax Return Income Tax Income Tax Preparation

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank